Micro-Saving for Millennials

In an era where financial pressures from student debt, skyrocketing rents, and the high cost of living dominate the landscape, Millennials are reimagining how to build wealth. Instead of waiting for a lump sum to save, many are embracing micro-saving—a strategy that transforms spare change and small contributions into a powerful tool for financial empowerment.

At its core, micro-saving involves setting aside tiny amounts of money regularly, often through digital platforms that round up everyday purchases or automate transfers. What might seem like insignificant sums can compound over time, leading to substantial savings. This incremental approach not only makes saving less daunting but also aligns perfectly with the busy, digitally connected lifestyles of Millennials.

Tech-Savvy Solutions

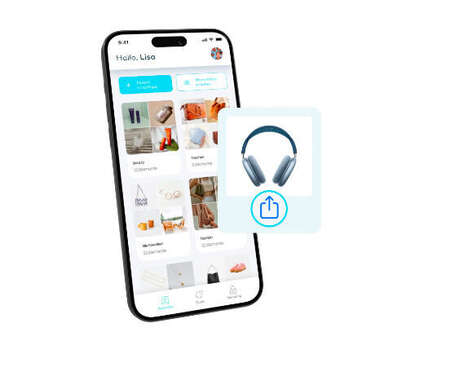

Fintech innovations are at the forefront of this trend. Apps like Acorns, Digit, and Qapital have revolutionized personal finance by integrating micro-saving features directly into our daily transactions. These platforms use algorithms to analyze spending patterns, automatically diverting small amounts into savings or investment accounts. The appeal is clear: minimal effort, maximum impact. For Millennials accustomed to instant gratification and seamless digital experiences, such tools are a natural fit.

Making Saving Fun

Many of these apps go a step further by adding a touch of gamification. With challenges, progress trackers, and even social features, they turn saving into an interactive and even competitive activity. Every small contribution feels like a mini achievement, motivating you to keep going and gradually build up your savings.

Small Wins, Big Impact

The beauty of micro-saving lies in its psychology. Traditional savings methods can seem daunting because they often require a large, upfront commitment. Breaking saving into small, bite-sized pieces makes the process less overwhelming. Each little deposit builds confidence and fosters a habit of consistent saving, which over time, leads to real financial stability.

A New Outlook on Wealth

This approach represents a broader shift in how Millennials think about money. Instead of relying on occasional, big deposits, they value steady, incremental growth. This mindset extends into other areas too, like micro-investing or crowdfunding creative projects. It’s a modern, hands-on way of building wealth that prizes smart, persistent habits over quick windfalls.

In short, micro-saving turns everyday spare change into a stepping stone toward financial empowerment—one small, consistent step at a time.

For more insights on how micro-saving and AI-driven personal finance strategies are reshaping millennials’ financial habits, explore Trend Hunter's 2025 Trend Report.