Making Ethical Investments

An Interview with Paul McQueen, VP of Wealth at Libro Credit Union

As the VP of Wealth at Libro Credit Union, Paul McQueen works with a world class team of investment and insurance professionals. A financial planner and analyst by training, with many years of financial industry management experience, his real passion is exploring investor behaviour. The fundamental concepts to grow and protect your wealth are relatively simple. The interesting questions should explore why does human behaviour often get in the way? Paul is currently pursuing a post-graduate diploma in Social Responsibility & Sustainability at the University of St. Michael’s College in the University of Toronto.

As the VP of Wealth at Libro Credit Union, Paul McQueen works with a world class team of investment and insurance professionals. A financial planner and analyst by training, with many years of financial industry management experience, his real passion is exploring investor behaviour. The fundamental concepts to grow and protect your wealth are relatively simple. The interesting questions should explore why does human behaviour often get in the way? Paul is currently pursuing a post-graduate diploma in Social Responsibility & Sustainability at the University of St. Michael’s College in the University of Toronto.1. Tell us your name and about your role at Libro Credit Union?

Paul McQueen. I am the Vice President, Wealth at Libro Credit Union. I work with a world class team of Investment and Insurance professionals (we call them "Coaches"), plus Administration and Compliance experts to grow and protect prosperity in southwestern Ontario. We are proud to be entrusted with billions of dollars of our Owner's assets, and we strive to provide great guidance and prudent advice, with the goal of inspiring financial happiness.

2. What does innovation mean to you?

I’m a financial planner by training, so problem solving is key. Every Owner we serve is unique, and there is no such thing as a “one size fits all” solution. As a leader and coach, I’m always thinking about the personal growth opportunities for our Team, and the resilience required by our Advisors to balance competing goals – personal, regulatory, societal, and corporate. Sometimes innovation can be minor such as continuous improvement in day-to-day processes. Sometimes innovation can be big, perhaps when we consider new ways to deliver our advice and service for the Owners we serve.

3. How do you and your team generate new ideas? Can you share any rituals you and your team rely on to reset creativity?

The best ideas usually come from the people closest to the problem, and we are working on ways to provide a ‘conveyor belt’ to forward those good ideas appropriately. We need to get better at explaining why some ideas are actioned, and others are not. We do lots of brainstorming. A good practice is to get all the ideas out without judgement first, and then try to find a few you can influence or control.

4. How do you identify trends? What resources do you use to spot trends and consumer insights?

Pretty traditional in many ways. We certainly watch our competitors, and review industry newsletters and publications, attend forward-looking conferences, etc. Our clients (Owners) often tell us what they want – or recently heard about. This can sometimes be tough, given there are lots of trends in the financial world that don’t always pan out. Over the past few years some of the “hot tips” have included cannabis, cryptocurrency, and NFTs, among others. We’ve tried to outline the difference between investing and speculating to deal with these questions. We’re very clear that there is nothing inherently ‘wrong’ with speculating, and we must be adamant that’s not what we do. Last, and certainly not least, you need to be committed to lifetime learning. No one knows it all, and everyone can benefit from a new perspective.

5. What is responsible investing and why should Canadians prioritize it, given the significant growth in responsible investment assets in Canada?

Responsible investing, sometimes referred to as sustainable, ethical, impact, and/or ESG investing, isn’t some stand alone concept. The idea is that sustainability concepts, Externalities, the Triple Layered Business Model Canvas, Planetary Boundaries, and Double Materiality, among others, should be additive to the foundational investing process. Investors who consider how value is created for all stakeholders should see stronger investment returns over time. A pretty ‘woke’ concept is that I can make more money and do better for the world and people around me. Highly recommend ‘Net Positive’ by Paul Polman as a remarkable story on how responsible investors and the corporate boardroom can thrive together.

6. Can you explain Libro Credit Union's responsible investment product offerings and how they incorporate ESG factors?

Libro Credit Union believes that responsible investing can lead to better financial returns while contributing to positive social and environmental impact. If you believe social issues matter to the long-term health and well-being of a business, and the future value of their stock price, you can no longer afford to ignore responsible investing considerations. These can include brand value and reputation, research and development, customer satisfaction, health and safety, environmental performance, governance. In fact, recent studies have shown that these “intangible” concerns can make up 87% (or more) of the value of large companies. Every new dollar invested for the long term through our investment dealer must be in a fund considered to be a responsible investment.

7. What are the key benefits of responsible investing and how do these apply to various types of investors?

As a species we only have this one planet, and so by definition it’s a preciously limited resource. Regardless of your position on climate change, your politics, or your background you are impacted by the world around us. We have found that most investors want to 1) take care of themselves and their loved ones financially and 2) they don’t want to do that on the back of anyone else. We’re a cooperative organization, and a proud B Corp. I don’t believe there is a specific segment of responsible investors. If you’re getting started with your $25 bi-weekly contribution, or running a $25 billion portfolio, your investment choices matter.

8. What is your advice for Canadians looking to effectively select the right responsible investment products that align with broader financial goals and values?

Don’t overthink it. Concerns about ‘greenwashing,’ etc., are real, but most fund providers and investment managers in Canada are committed to influencing real change. It’s not just a marketing exercise, as the smart money already sees that companies that are more sustainable, are more secure and more profitable over time. Organizations that can sustainably reduce costs while increasing revenues, strengthen their supply chains, all while reducing reputational risks, should attract more investment dollars. Efficient markets should quickly reward these efforts with increased returns, resulting in improved portfolio performance by smart asset managers, who should in turn see higher fund inflows, creating a potential virtuous circle of sustainability.

9. Looking to the future, how will Libro Credit Union continue to be a leader in innovation?

We are in the relationship business, at the end of the day, in a highly regulated industry, where the burden of regulation shows no signs of slowing. How do we continue to connect with the disparate types of Owners we serve and do it profitably and competitively? We need to encourage experimentation, and risk taking. We need to continuously invest in our Talent. We need to embrace technology. We need to continue to evaluate outcomes with our new Agile process methodology. We need a clear strategy that everyone in the organization understands and drives consistency in our

tactical outcomes. Fundamentally, we need to be Owner-centric in everything we do. This process never ends and will require a tremendous amount of persistence if we want to continue to be relevant going forward to all our stakeholders.

References: libro

Featured Articles

Gen Z Investing

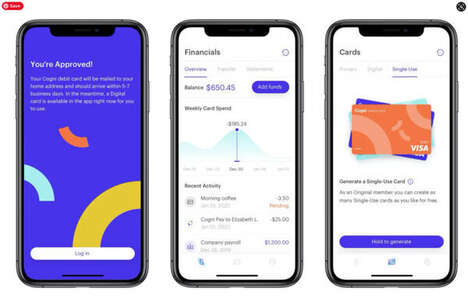

Investing for young Gen Z consumers is made easier with apps and communities

Freelancing Finance

Banking apps for freelancers help streamline their personal finances

Community Banking

Banking platforms and spaces are prioritizing social engagement and community

Wealth Accessibility

Gen X as a whole is more focused on building generational wealth

Gen Z Neobanking

Fintech responds to new financial needs with neobanking solutions